colorado estate tax form

A state inheritance tax was enacted in Colorado in 1927. DR 0102 - Deceased Taxpayer Claim for Refund.

Colorado Sole Proprietorship Colorado Business Attorney

If the date of death occurs prior to December 31 2004 Form DR 1210.

. Other colorado estate tax forms. If a decedent is due a refund of any individual income tax after filing a return Form DR 0104 you may claim that refund using Form DR 0102 -Claim for Refund on Behalf of a Deceased. Extension of Time for Filling.

DR 0002 - Colorado Direct Pay Permit Application. DR 1102 - Address or Name Change Form. Sign it in a few clicks.

Draw your signature type it upload its image or. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. DR 1778 - E-Filer Attachment Form.

The types of taxes a deceased taxpayers estate can owe. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. 223 rows Sales Tax Return for Unpaid Tax from the Sale of a Business. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing.

We will update this page with a new version of the form for 2023 as soon. Extension of Time for Filing Individual Income Tax Payment Form. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

Type text add images blackout confidential details add comments highlights and more. DR 1830 - Material. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest.

Even though there is no estate tax in Colorado you may still owe the federal estate tax. Colorado Estate Tax Form. Employer Forms CR 0100 - Sales Tax and Withholding Account Application DR 1093 - Annual Transmittal of State W-2 Forms DR 1094 - Colorado W-2 Wage W.

DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. Colorado has a new tax form available for employees to make changes to their Colorado state tax withholding. July 17 2022 by Employee Services.

DR 0104PN - Part-YearNonresident Computation Form. Form DR 1210 is a Colorado Estate Tax form. DR 0900F - Fiduciary Income.

Form 105EP is a Colorado Estate Tax form. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. Until 2005 a tax credit was allowed for federal estate.

DR 0104EP- Individual Estimated Income Tax Payment Form. DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004.

Other colorado estate tax forms. The Colorado income tax rate for tax year 2021 is 450 The state income tax rate is displayed on the Colorado 104 form and can also be found inside the Colorado 104. DR 0084 - Substitute Colorado W2 Form.

DR 0204 - Tax Year Ending Computation of Penalty Due Based. Edit your form online. DR 0104X - Amended Individual Income Tax Return.

The filing of the bankruptcy estates tax return does not relieve a debtor from the requirement to file his or her. DR 0104EP - 2022 Individual. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

DR 0253 - Income Tax Closing Agreement.

Fiduciary Income Tax Department Of Revenue Taxation

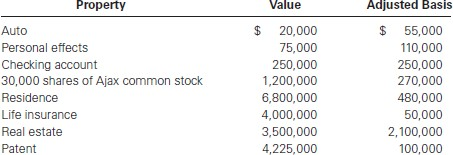

Solved Estate Tax Return Problem Clark Griswold Is A Chegg Com

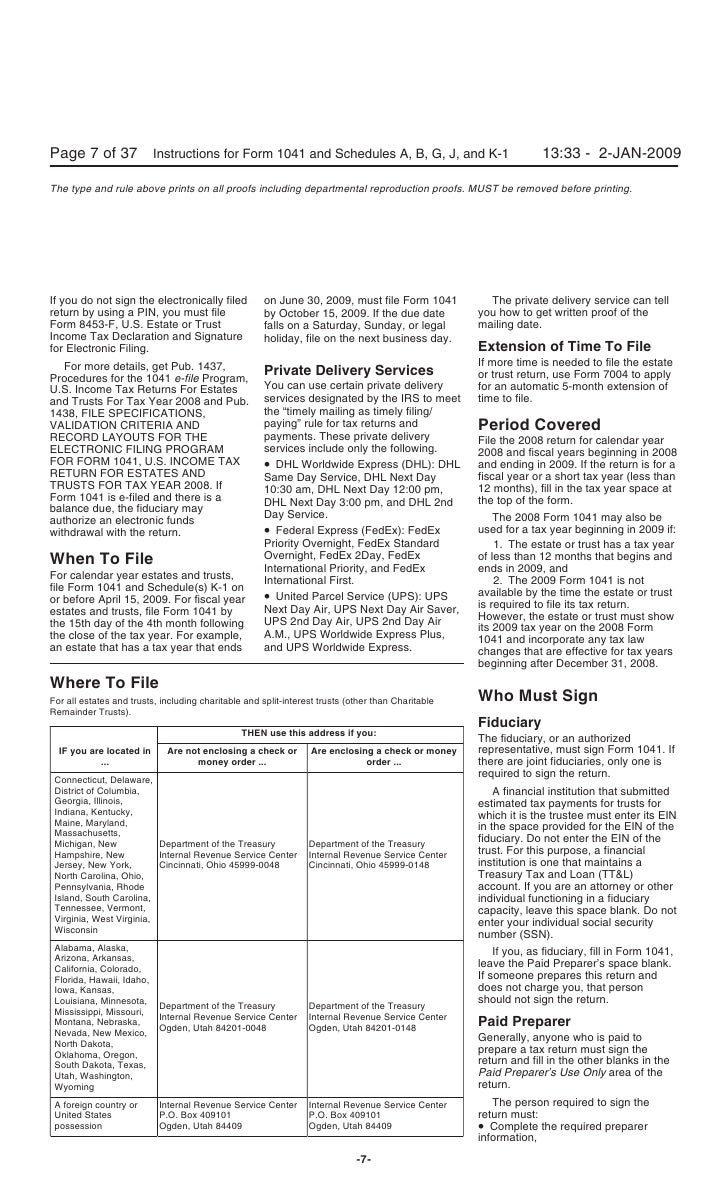

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Where S My State Tax Refund Updated For 2022 Smartasset

Free Colorado Revocable Living Trust Form Pdf Word Eforms

Closing Statement Colorado Fill Online Printable Fillable Blank Pdffiller

How To Obtain A Tax Id Number For An Estate With Pictures

Colorado Property Tax Guide For Dummies How They Work And What You Can Do Next 9news Com

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Tax Forms Irs Tax Forms Bankrate Com

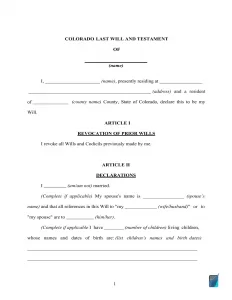

Fillable Colorado Last Will And Testament Form Free Formspal

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Comments

Post a Comment